Crypto Oracles in 2023: Will Chainlink Hold the Top Spot?

Content Marketing

What are crypto oracles?

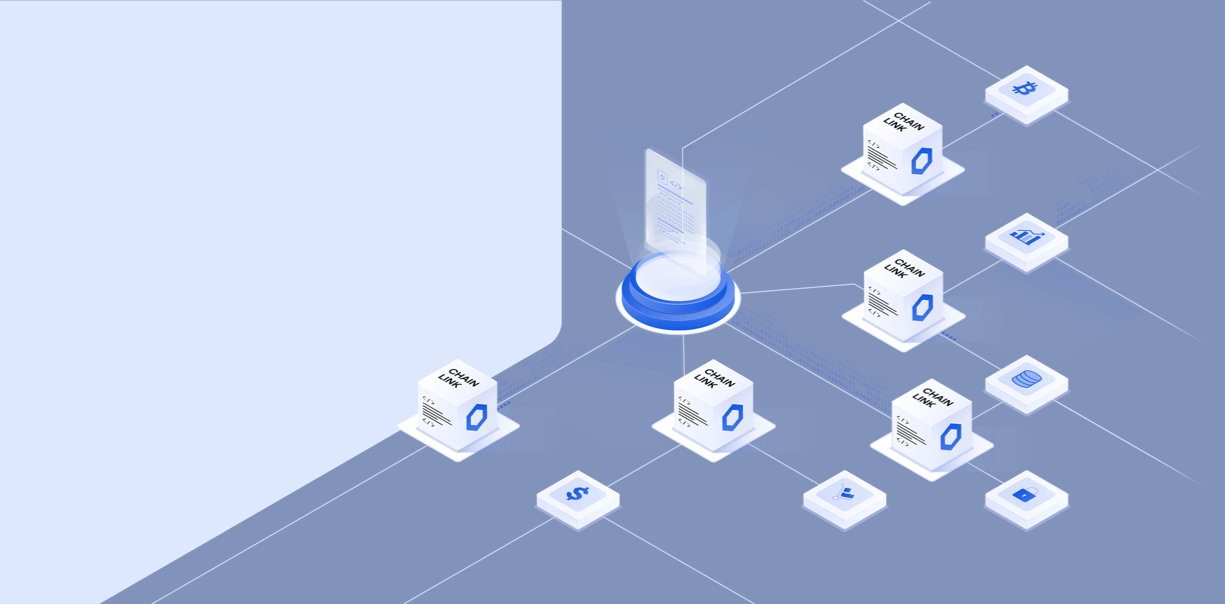

Crypto oracles, also known as “blockchain oracles,” are third parties that connect blockchains to other systems. In practice, an oracle is like a bridge between the blockchain and the wider world. You can also think of them as courier agents connecting two data points.

Oracles are not sources of data, as the name traditionally implies. Rather, they query and verify external data. Once the data is authenticated, the crypto oracle relays the information. But this can mean many different things. One obvious example would be payment authentication.

Why are crypto oracles needed?

The primary purpose of crypto oracles is to facilitate smart contracts. But they also serve to improve trust by verifying and authenticating data.

Relevant off-chain data needs to be available for smart contracts to execute, but blockchains and smart contracts aren’t able to access data off-chain (outside the blockchain network) on their own.

This is where the oracles serve their purpose. They link on-chain and off-chain data, thus broadening the scope of smart contracts. Without oracles, smart contracts would offer less usability. Smart contracts can receive data relayed by an oracle, and then send the data off-chain.

There are many different types of crypto oracles. Each individual oracle operates in a unique way based on what it’s designed to do. Let’s look over the top oracles and outline what the near future holds in store for them.

Why is Chainlink the King of oracles?

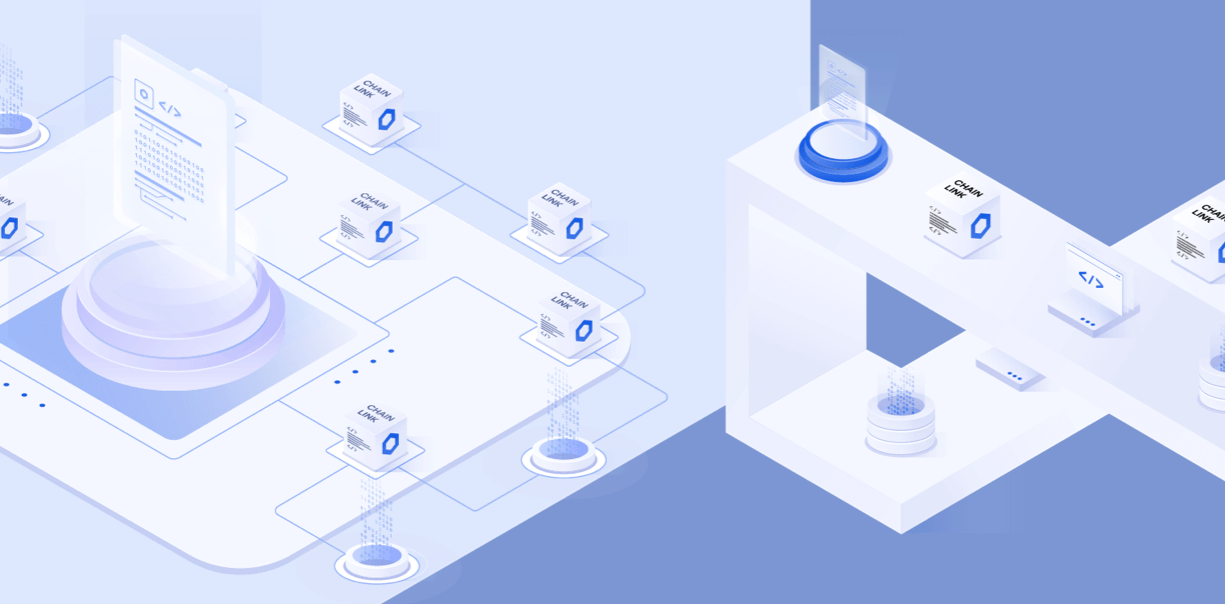

Chainlink is a home for decentralized oracle networks. It is the current leader in the oracle space for two main reasons:

- Security: Chainlink security is provided by many industry-standard security features employed to provide a tamper-proof ecosystem.

- Flexibility: Chainlink offers the flexibility to create, but also comes with many pre-built solutions. The pre-built oracles have been used and tested before in other smart contracts. Users can integrate them into their own decentralized applications.

Chainlink also has its own automation nodes to automate contracts. This increases security because the nodes are secure and resistant to tampering.

Chainlink integrations and partnerships

Chainlink is the current leader when it comes to its larger role in the decentralized finance space. They are currently partnered with over 200 companies.

Also, the oracles can integrate with most Ethereum-based decentralized finance projects. This has allowed Chainlink to benefit more from decentralized finance’s recent activity. Finally, despite the crypto economy’s recent overall performance, Chainlink’s LINK token has been performing relatively well.

Chainlink token

Chainlink Token (LINK) is the currency used to pay Chainlink network operators for the retrieval of off-chain data. The tokens support the computational demands of the operation.

LINK was launched with Chainlink in 2017. Unlike the traditional, centralized oracles, Chainlink decentralized the process by using its LINK tokens to reward network operators that go to off-chain feeds to gather information, format data so it’s usable, and perform computations off-chain.

Node operators stake a certain number of LINK tokens. They then set their own fees, which are based on the demand for the off-chain data they can provide. It’s an ERC-20 token, so it is compatible with other Ethereum (ETH) blockchain currencies and smart contracts.

Projects using Chainlink

There are over 200 companies partnering with Chainlink. Some prolific use cases include:

- Link My Ride: A decentralized rental platform specifically for Teslas.

- Digital Bridge: Provides two-factor authentication for smart contracts.

- SecretPay: Used for buying ETH privately from PayPal or Revolut.

- Marine Insurance: Parametric insurance for marine industries.

The top 5 current oracles

These are the top five current oracles in 2022 by market cap, according to CoinGecko:

- Chainlink

Chainlink, for all its advantages and drawbacks, is still by far the largest oracle. With a market cap of over $3.8 billion, the runner-up doesn’t come close in terms of projects and other activities.

- UMA

UMA’s oracle (Optimistic Oracle) can gather data from any public source, but offers dispute resolution for any inaccurate data. The platform was launched in 2018, reaching a market cap of over $150 million.

- API3

API3 is a first-party oracle, meaning that they publish retrieved data directly to the blockchain. They are the API provider themselves. The token, API3, has a market cap of over $100 million.

- Nest Protocol

Nest Protocol is another decentralized oracle built on Ethereum. The native token, NEST, has a market cap of over $100 million.

- WINkLink

WINkLink is another decentralized oracle, but it runs on the TRON network. The token (WIN) has a market cap of just under $100 million.

What is ERG and what are ERGO oracle pools?

Ergo (ERG) is a blockchain that is used to design decentralized apps. Their goal, according to their whitepaper, is to make financial contracts more efficient and safer.

The Ergo blockchain uses multi-stage contracts, combined with another version of the Bitcoin UTXO model. With Cardano using Ergo oracle pools from 2020, Ergo was off to a good start just one year after its launch.

Ergo offers what they refer to as a “hierarchy of trust” that the Ethereum account-based model cannot create. The idea is that oracles can quickly access a vast amount of information but can’t ensure that everything is accurate or that all sources are trustworthy. So they assess and assign “trust scores” to different data sources.

ERGO oracle pools

Ergo uses an enhanced version of Bitcoin’s original UTXO model. The oracle pool breaks down time into periods called “epochs.” These are subdivided time blocks where groups of oracles in the pool assess data sources and post their own results in the blockchain in their own UTXO.

After each epoch, outliers are removed, and the data points are averaged. A new and final data point is created before moving on to the next epoch.

While this is a very simplified explanation, it’s easy enough to understand. The whole process happens on the blockchain, with UTXOs offering governance and incentives. This all supports the final goal of creating a more sophisticated on-chain process.

Will Chainlink remain dominant in 2023?

Chainlink could maintain some bullish momentum into 2023. Should a bullish rally and streak occur, Chainlink could very well solidify and maintain its place as the top oracle coin by market cap.