Summarizing the Great Crypto Winter: How Did This All Happen?

Jack Choros

Content Marketing

We are living through the worst Crypto Winter we have ever seen.

At the time of this writing, the price of Bitcoin is hovering around $26,500 Canadian, approximately eight months after reaching its all-time high of $85,656.04 Canadian.

If you’re an active crypto investor that follows crypto news regularly through the weekly posts found right here at Netcoins, or your favourite YouTube influencers or news sites, then you know exactly what’s happening.

Whether you accept this Crypto Winter as reality because you’re looking at the broader economy or because you understand what’s happened over the last year as it relates to crypto projects directly, I think we can both agree that it’s mighty cold out there these days.

That said, taking the time to dissect the world’s macroeconomic situation and the inner workings of the collapses that we’ve seen in crypto lately could make you a better investor.

That’s why in this post we’re going to answer one of the most obvious, yet thoughtful questions that anybody interested in crypto should be exploring: How did this all happen?

Crypto Winter Started Three Years Ago Thanks to COVID-19

The first large cluster of COVID-19 cases were reported to have appeared in Wuhan, China in December of 2019. By the middle of winter in 2020, the first North American cases began to reveal themselves.

One of the big milestone moments that changed everything in North America was when a well-known NBA player named Rudy Gobert tested positive for the virus. It was at that time that major sports leagues, event companies, and corporations around the world realized that business wouldn’t be as usual for a long time.

Governments around the world, including our Canadian government, began telling people to stay home while reassuring citizens they’d be able to pay their bills using financial aid programs. Thus, we Canadians were introduced to the Canadian Emergency Response Benefit program. That program is now closed, as are many other benefit programs related to the pandemic.

While our day-to-day life is starting to get back to normal, money printing programs like CERB have already done a lot of economic damage.

How Markets Reacted to Money Printing

When the Western world first realized the spread of the coronavirus was turning into a global pandemic, markets reacted exactly the way you would expect. They plummeted. In less than six weeks, from early February to late March 2020, the S&P 500 dipped more than 31%.

Today, the S&P 500 has a market capitalization of nearly $37 trillion USD. It’s more than 37 times larger than the value of every crypto project in the world combined. A 31% drop in less than six weeks is a serious drop.

Right after that drop, everything seemed to turn on a dime. As more and more people in the Western world were collecting checks and staying home, they found themselves with extra money they didn’t have to work for and decided to invest that money in both crypto and the broader financial markets.

The race to new all-time highs across the crypto world, including highs for Bitcoin, Ethereum, non-fungible tokens (NFTs), and the rest of the Web 3.0 world, was on.

Why Both Crypto and the Broader Economy Are Crashing Now

When people have more money to invest, they are getting richer. But it also means they are now buying the same supply of goods and services with that increased wealth.

Once people start buying up goods and services and they become scarcer, demand for those goods and services increases.

When demand goes up, so does the cost. This is how you get inflation. This is how you get to a point where filling up your gas tank costs more than two dollars per litre. This is how you get to the point of airlines like Air Canada are cutting their operations in half throughout the summer because they can’t accommodate pent-up demand for travellers itching to get out into the world and go on vacation.

It’s also how you get investors taking their money out of riskier assets (like crypto), or losing their money altogether because they were risking too much when times were good, and they’re paying the price now that times are bad. In many ways, our financial systems have pushed people up the risk curve.

Although crypto and Web 3.0 projects are still exhibiting massive future potential, they would fall into the category of riskier assets investors are currently pulling out of. They also appeal to investors who maintain a higher propensity for risk (who might be more likely to borrow money for investing) and thus, may be having investing positions liquidated.

Let’s get more specific and dive into the wild occurrences within crypto that COVID-related money printing triggered three years ago (and that we are just paying for now).

The Idea That Crypto Is a Hedge against Inflation Isn’t Holding Up Well Right Now

Perhaps decades from now when having some of your wealth in crypto becomes commonplace for all of us, bitcoin and other cryptocurrencies whose circulating supply can’t be easily manipulated may be a great hedge against inflation or a recession. But right now, for some, it’s arguably not the case. Crypto is moving in lockstep with all of the major indexes that run the traditional financial world at the moment.

While the supply of cryptocurrencies and the blockchains they live on can’t be easily manipulated, what we’ve seen particularly in the last nine months in this industry proves that both whale investors and innovators who rise to fame and fortune in the crypto world still use the leverage they garner to their advantage. That’s the problem that sits at the root of all of cryptocurrency’s most recent collapses. Including that of Terra, and Three Arrows Capital.

Let’s briefly cover the downfall of the above. But before I dive into that, I’d like to explain one thing to you.

Clout Plus Capital Equals Leverage

When you hear or read somebody talking about pegged assets, you’re likely learning about stablecoins and wrapped assets (a.k.a. derivative tokens). Stablecoins can function well as on and off-ramps to more volatile crypto assets. They can allow you to avoid the volatility of crypto and engage in borrowing and lending without having to convert crypto to fiat and depart the crypto market entirely.

But think about this. Since stablecoins don’t fluctuate in value and they are not serving a use case beyond acting as on and off ramps or borrowing and lending utilities (like incentivizing the building of decentralized applications within their blockchain ecosystems the way Ethereum does for example), there are only a couple of key reasons anybody should ever want to launch a stablecoin.

The first reason is to make money off of transaction fees. Second, companies use stablecoins to elevate their branding or marketing strategy (most people who are really into crypto know that USDC is backed by a bigger company called Circle for example).

The third benefit to operating a stablecoin is that if yours grows in market cap or influence, you can leverage that to broker deals for yourself with big crypto companies, exchanges, DeFi protocols or lending platforms.

This is the big problem with cryptocurrency’s most popular stablecoins. The founders of these projects eventually get to a level where they can use hundreds of millions or even billions of dollars worth of crypto to their advantage, try to leverage that opportunity to earn more when times are good, and potentially leave everyday investors in the cold when the next Crypto Winter comes around.

The Terra Luna Example

The TerraUSD stablecoin is an algorithmic stablecoin that manipulates supply and demand so that the value of one coin stays as close to one dollar as possible. While these kinds of stable assets work in theory, they are not perfect.

One of the reasons the Luna project and its corresponding stablecoin grew so quickly is because Anchor Protocol offered up to 19.5% interest on the stablecoin, which is way higher than most other borrowing and lending platforms can offer on stable assets.

To make a profit, Luna holders would trade their tokens for a stablecoin, Terra, and sell it back to the open market for slightly more than one dollar. As long as they thought the stablecoin would increase in reach and utility, there was reason to continue holding Terra. If more people demand Terra because they think the stablecoin will have a larger presence in the broader crypto world, the market cap of the stablecoin goes up, and the dollar value of the volatile asset, Terra, also goes up.

A rising tide lifts all boats. The problem with this is that when you add a 19.5% interest rate to a tide that’s already rising, Terra and Luna become too big, too fast.

If something happens to that 19.5% interest rate or the founder of the project wants to use leverage to buy bitcoin and everything starts to collapse, all of a sudden people begin cashing out the stablecoin for Terra, and then cashing out UST stablecoin for Terra to try and get out of the Luna ecosystem entirely.

The last ones out of that door are the ones left hanging onto the bags. For a greater understanding of what happened, watch this extended interview featuring experts on the subject or this explanation of how Terra and Luna work.

What Happened to Three Arrows Capital?

Su Zhu and Kyle Davies are American expats who co-founded Three Arrows Capital. They took their own money and invested it in crypto projects, turning millions of dollars they earned through trading foreign currencies into over $10 billion worth of crypto assets at the height of the crypto boom last year.

Thanks to the tremendous success they experienced in just a few short years, Zhou and Davies developed a reputation for taking big risks with investments designed to earn them 30% plus on mega deals most people wouldn’t have the guts to bet so big on.

Since they had such a great reputation, they were able to borrow money that was under collateralized from several of the biggest names in crypto including Voyager Digital (which is now bankrupt) and Genesis Mining.

Large investment and venture capital firms focusing on any niche including crypto can go to zero zero. Ivesting after all can be a high-stakes game, especially when you are extra aggressive to the tune of billions of dollars. Big problems can arise when you borrow more money than you have and end up losing it.

Putting Things into Perspective on a Larger Scale

Think about it. On a small scale when you borrow money from a crypto protocol or take money out of a line of credit from a bank because you think you can throw it into crypto or stocks and win big and you lose, you now have to work harder to pay off your debt.

On a larger scale, if you borrow $10 billion from five different companies and they find out that you don’t have the money to cover your losses after the fact, those losses end up on the balance sheets of those other companies. Now you’re not just risking your financial well-being or that of yourself, or your company, you’re risking the financial well-being of several other players in the market.

In a young market like crypto, the trickle-down effect of such an event can cause the average investor to lose lots of money. It can also send the whole industry into a downturn. That’s partly what we’re seeing right now.

The Straw That Usually Breaks the Camel’s Back

When a few big platforms in crypto are borrowing money to try to make billions of dollars and the market turns down sharply, as I mentioned, the responsibility now falls on all of the companies involved to take the losses on their balance sheets, and those companies look to banks because they borrow money too.

What can the banks do to hedge their risk? They give all these borrowers a margin for investing that guarantees if something bad happens the bank can recoup their losses.

When a big downturn happens, banks start calling on these big companies to re-establish a safe margin by investing more money to account for recent losses. Of course, if companies are borrowing billions of dollars they can’t afford to lose, that means banks and lenders are going to liquidate the positions of their borrowers at a loss.

Therefore, the lenders loaning money to these large crypto platforms are safe, but the institutional investors themselves (in this case Three Arrows Capital), are dead in the water.

For a more detailed understanding of what happened to Three Arrows Capital and what it means for the future of crypto, I strongly recommend watching this one-hour discussion.

Use Netcoins to buy Crypto at Prices We Haven’t Seen in Years

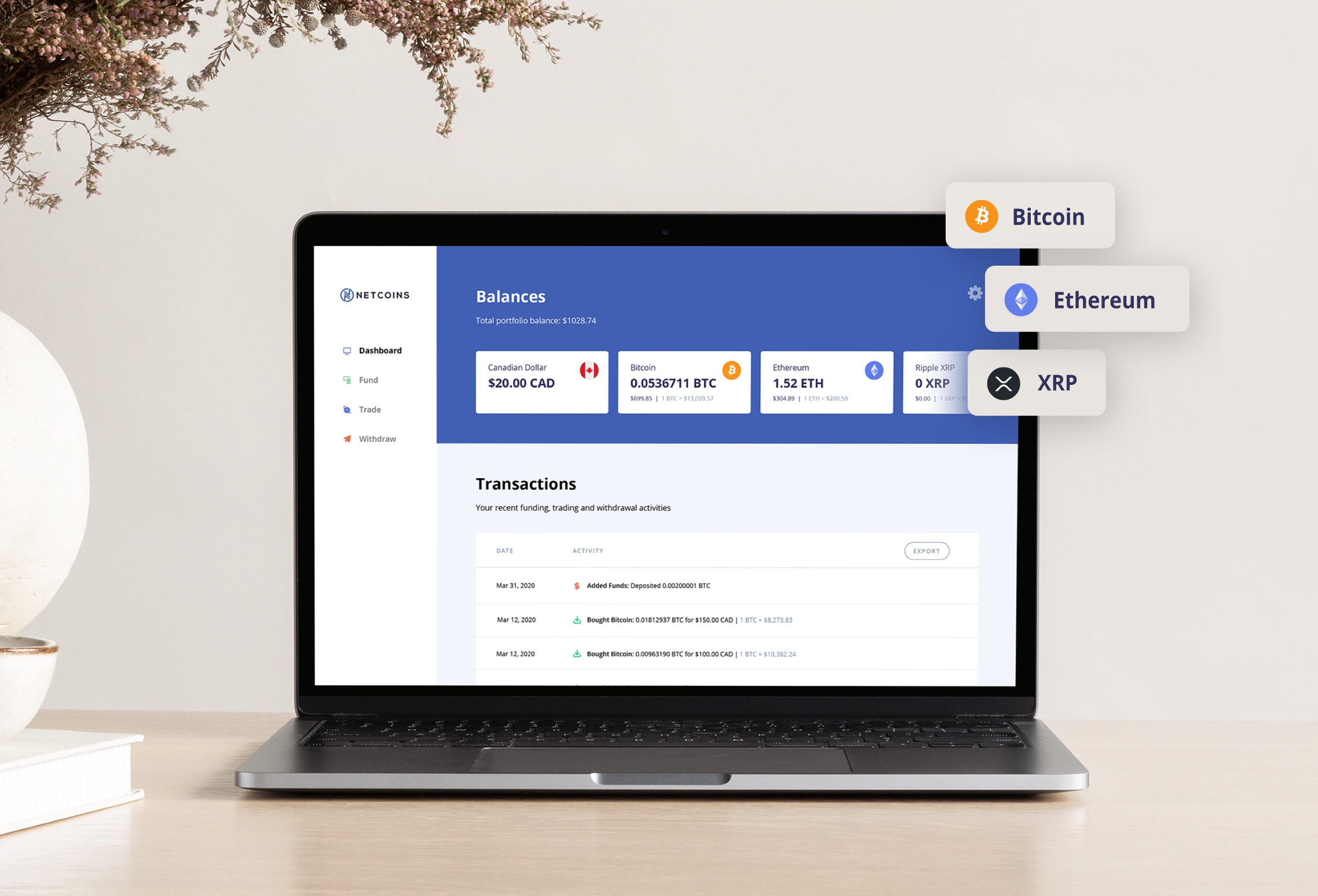

Signing up for a Netcoins account is easy and now is probably the best time to do so given that we are staring at crypto prices the market hasn’t seen in many years.

Netcoins’ presence in Canada continues to grow despite the fact the broader economy is currently going through a recession. That’s not going to change anytime soon. Part of the reason is because they Canada’s first publicly-traded, fully regulated crypto trading platform. Netcoins started out offering just a handful of cryptocurrencies for you to buy, sell, and trade a few years ago.

Today, you can trade more than 35 cryptocurrencies including both stalwart assets like Bitcoin, Ethereum and Litecoin as well as more trendy cryptocurrencies like Shiba Inu, Apecoin, AVAX, and MANA.

Remember when you sign up you can trade existing crypto that you already own for other coins or tokens, and you can also purchase crypto using Canadian dollars.

It’s very difficult to predict when crypto prices will hit rock bottom or when they will shoot for the moon, but given the Crypto Winter we’re currently living through, if your conviction in the future of crypto is strong, now is probably a good time to consider a dollar-cost averaging strategy that will give you a crypto-friendly position you’re satisfied within your broader investing portfolio.

Written by: Jack Choros

Writer, content marketing at Netcoins.